Last week we saw several changes in the mortgage industry that will directly affect our Real Estate industry. Here are some need to knows:

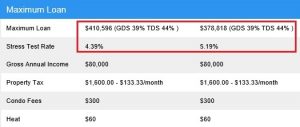

Stress-Test

The stress-test changes slated for April 6th are suspended. The posted mortgage rate, published weekly by the Bank of Canada, will remain the qualifying mortgage rate. It is currently 5.19%, but it is expected to fall this week to around 4.95%.

Mortgage Repayment

CMHC is highlighting their Mortgage repayment options for those effected with making their mortgage payments. The best thing a homeowner can do if they fear they won’t be able to make their mortgage payment is get out in front of it as soon as possible and let their lender know. Many lenders have payment deferral options that will actually allow borrowers to skip a payment if they come into financial hardship. For more information on what CMHC suggests please view this website: Dealing With Mortgage Payment Difficulties

Rising Risk-Premiums

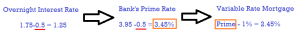

Bank’s are rising their risk premiums due to the expectant recession which is causing an increase in fixed mortgage rates and a tightening of the discount off the prime rate on variable-rate mortgage loans. This widening spread between mortgage rates and government yields is typical behaviour during a contracting economy, and took place during the financial crisis in 2008. During the crisis, rates continued to decline even with the widened spread.

Banks of Canada Rate Cut

The Bank of Canada is hopeful that its rate cuts will stabilize the housing market from what might have otherwise been a substantial shutdown. Expect the Bank to cut rates again to near-zero levels, following in the footsteps of the Fed. So far, as of this writing, the Canadian banks have not responded to Friday’s BoC rate cut. The prime rate went down a full 50 bps on March 5 after the Bank cut its key rate by that amount on March 4. But so far, the Big-Six banks have not responded to the 50bps cut three days ago.