3-Types of Mortgages to Finance Your Home Renovation Project

Are you interested in turning your home into your dream home? This piece is all about the 3-financing options available to homeowners and future homeowners to fund their renovation projects.

The 3 types of products offered by prime lenders are:

-

Home Equity Line of Credit

-

Refinancing or 2nd Mortgage

-

Purchase Plus Mortgage

The first two options involve withdrawing equity out of your house. While the Purchase Plus Mortgage option allows you to add the costs of your completed renovation project to your mortgage. I’ll explain more on that later.

So lets break down our first 2 options: the home equity line of credit or HELOC for short and, Refinancing or adding a 2nd mortgage.

The maximum amount of funding provided by these two options is determined by our income and what’s known as our Loan-to-Value. We’re not going to discuss income requirements, but I would like to discuss the main limiting factor, which is Loan-To-Value.

So what is Loan-To-Value? Loan-to-Value is a ratio of how much our outstanding mortgage balance is, to the Current fair-market value of our home. If we have a home worth $500,000 and our outstanding mortgage balance is $250,000, then our loan-to-value is 50%.

Remember this 50% number because we will be using it later.

Option 1 – Home Equity Line of Credit

Our first option is a Home-equity line of credit. Line-of-credits are an excellent way to fund renovation projects because they are flexible. They allow us to withdraw money as we need rather than a lump-sum, and many interest only payments. Lots of benefits packed into these products, but they do have a downside.

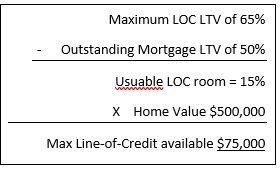

Mortgage rules dictate the maximum Loan-to-Value allowed for a home-equity line of credit is 65%. So, if we apply this rule to our scenario it will look something like this.

Option 2 – Refinance / 2nd Mortgage

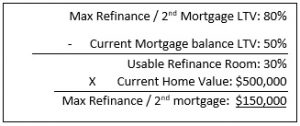

Mortgage rules allow us to refinance our original mortgage or take out a 2nd mortgage up to a maximum of 80% Loan-To-Value, but unlike the Line-of-Credit, this option requires you to take the full amount as a lump-sum. Meaning the lenders will transfer the entire amount requested into our account, and we will begin making the necessary payments on this new amount whether we’ve used it or not.

If we apply this option to our scenario the maximum amount available to us is $150,000.

Option 3 – Purchase Plus Mortgage

This option is unlike the others for a few key reasons.

Firstly, the Purchase Plus Mortgage is for prospective homeowners, not current homeowner. And, the program is available to high-ratio mortgages, as well as conventional mortgages. To really explain the benefits of this mortgage program let me give you an example.

Let’s say we’re actively looking to purchase a home and we’ve been pre-approved for $540,000. During our search we find the perfect home for a price of 500k, but it needs a few updates, new floors, paint, cabinets etc. If we use our standard mortgage, we will only receive funding for the original price of the home which is $500,000.

However, with the purchase plus option, we will receive funding for the original home price of 500k plus the cost of the additional renovations. Up to $40,000 with a high-ratio mortgage, and $60,000 for a conventional mortgage!

So there you have it, 3 options to fund your home renovation project and turn your home into your Dream Home.

If you have any questions, or would like to take advantage of these programs please call me at 778-215-4121