Fixed Rate or Variable Rate?

We are approaching interesting times. The world economy is slowing down due to heightened tensions with the coronavirus, oil prices, blockades etc etc, the list goes on.

One positive spin on this whole fiasco is cheaper mortgage rates, Yay!

When an economy is contracting like this the government steps in to lower the overnight interest rate to make borrowed money cheaper to ease expenses and “hope” new borrowed money will be put to a productive use.

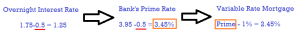

On March 4th, the Bank of Canada did just that. They decreased the Overnight Interest Rate from 1.75% to 1.25%. This caused retail banks’ Prime Rate to drop from 3.95% to 3.45%.

The decrease in Prime Rate directly effects variable rate mortgages, and people saw their interest rate decrease by half a point overnight.

As it stands, variable rate mortgages are an extremely attractive product. If the economy continues on this contraction trajectory, it is likely we will see more rate cuts in the future, but don’t expect them to happen as quickly as you may think. Keep in mind we’ve been expecting Bank of Canada to decrease the interest rate for almost a full year and they’ve finally responded.

I suspect the Bank of Canada will follow their typical strategy of waiting 3-6 months and seeing how this rate cut effects the economy before adjusting the rate again.

The average variable rate mortgage product is Prime (3.45%) minus 0.75% to 1%; so 2.45-2.70%.

The beauty of a variable mortgage is in its flexibility. These mortgages offer excellent repayment features, and their penalties for breaking a contract are only 3-months interest – which is substantially lower than most lenders IRD penalty for fixed-rate mortgages.

For those homeowners looking for a stable mortgage payment, fixed rate mortgages are still a great buy. They are extremely cheap and getting cheaper daily!

Insured Mortgages are averaging: 2.39%

Insurable Mortgages (owner-occupied): 2.39-2.64%

Conventional Mortgages (over 1 mil, Rental properties, Non-owner occ): 2.64%