How to Purchase a 2nd Home with a 5% Down-Payment

Did you know you can purchase a 2nd home or a vacation property with as little as a 5% down-payment?

That’s right, these mortgage products are available to home-owners, renters and first-time home buyers!

Why don’t more people take advantage of this program?

Lack of knowledge on insured mortgage programs. Of the 3 mortgage insurance companies, Sagen is the only company actively promoting their 2nd home mortgage program.

Most people are unaware this program exists, or are misinformed and were told mortgage insurance products are reserved only for first-time home buyers.

Is there a catch with this program?

There is no catch, but adhering to mortgage insurance policies can be stricter than banking policies.

- Maximum amortization is 25-years

- Maximum purchase price is $1 Million

- Minimum down-payment: 5% on first $500k, 10% on $500k – $1 million

- Income must be able to debt-service both homes (Mortgages, property taxes & heat)

- Rental income is not allowed in the mortgage calculation

Affordability Strategies

To unlock additional mortgage qualifying room for this program it may be necessary to re-arrange outstanding debt obligations. Two well used strategies are:

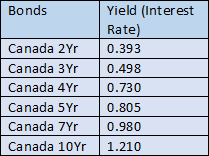

- Refinancing your current mortgage to take advantage of lower rates and/or extend the amortization

- Consolidating car loans, credit cards or outstanding lines of credit into a single low-interest debt payment.

Want to learn more about this program?

Contact Adam Sale Mortgages @ 778-215-4121 or adamjsale@gmail.com