Month: December 2022

Inflation Rate & Consumer Price Index Predictions for 2023

Posted by: Adam Sale

Inflation Rate & Consumer Price Index Predictions for 2023

Hi folks,

On November 15thh the October inflation rate and the consumer price index (CPI) report was released.

The Consumer Price Index is the underlying data used to determine the rate of inflation.

For the 5th month in a row, the Consumer Price Index remained relatively flat, posting only a 0.9 point gain over this period.

This is much lower than the 6.6 points gained over the previous 5-months

(January 2022 – May 2022 – take a look!).

If the Consumer Price Index has slowed considerably, why haven’t we seen any major decreases in the inflation rate yet?

The inflation rate is calculated on a yearly basis, and uses the corresponding month from the previous year as the base.

As we move through the months of January 2023 to June 2023 we will use the months of January 2022 – June 2022 as our base, it is within these inflation reports that we will see considerable decreases in the inflation rate.

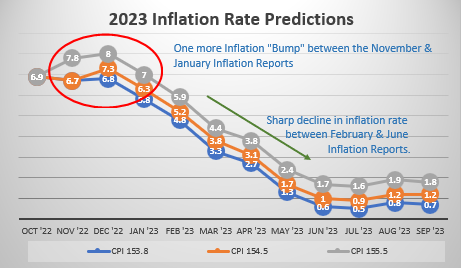

Take a look at the graph below where I plotted the expected inflation rate using 3 different CPI Values (153.8, 154.5 & 155.5).

In all 3 of these models, we notice one more increase in the inflation rate during the December report (released in January), and then a significant drop in the inflation rate beginning from the February report (released in March) – right in time for the Spring Market.

How to Use this Information for Your Benefit?

We are in a period of uncertainty; many buyers don’t want to purchase a property until the following conditions happen:

- Inflation Rate decreases

- Housing Prices decrease

- Interest rates decrease.

In an extremely desirable market like Greater Vancouver, I have my doubts we will see all three of these conditions at once.

As the inflation rate decreases in March-June, fixed mortgage rates will decrease and consumer confidence will return to the market. When fixed interest rates decrease, buyers’ purchasing power increases and housing prices in the lower mainland will stabilize.

The best time to purchase a property in the Greater Vancouver area is between now and March 21st. The competition for a property is lower, prices have softened, and if you can opt for a longer completion date you will have a better opportunity of getting a lower mortgage rate.

If you’re waiting until June – August to purchase a property, you may get a better fixed mortgage rate, but consumer competition will be increasing and it is likely we will see prices across many property types increasing as well.

For further information on everything mortgages, please contact me at 778-215-4121.