How to Time the Market

Unlike other real-estate markets in Canada, it is extremely tough for the Vancouver market to turn into a buyers market when the demand to live here is so high due to immigration and lack of supply.

Even if/when the market starts to favour buyers more than sellers the realestate prices do not decrease much unless you are looking at properties priced on the higher end of the spectrum (+1.5 mil), and more so in the (+3 million).

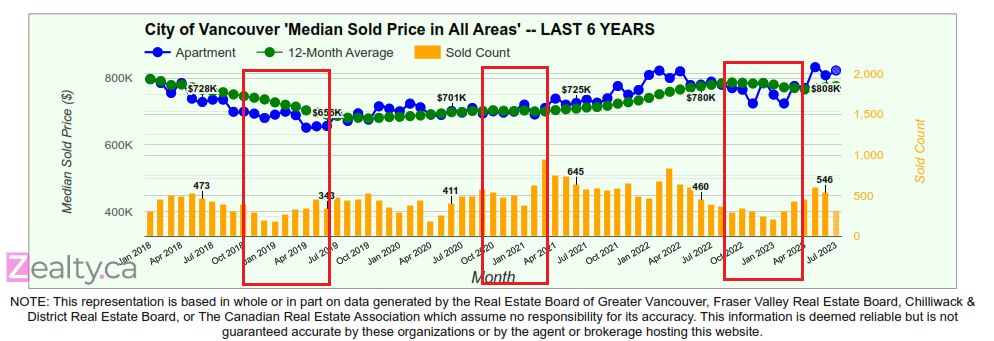

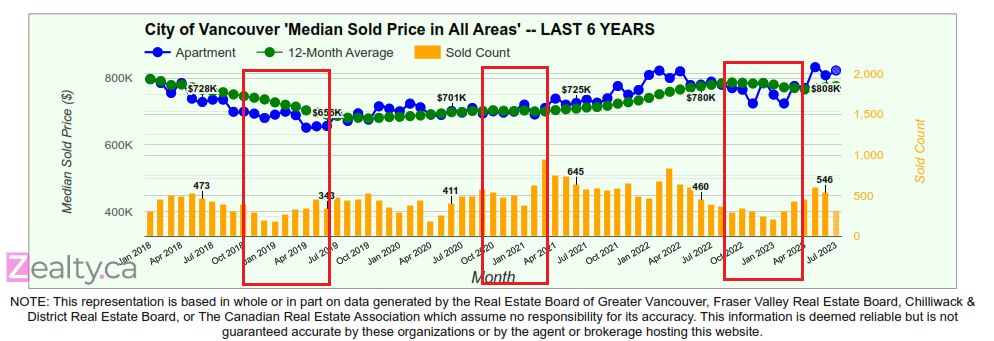

One of the indicators to keep an eye on to spot the best deal is Volume of Recent sales (units sold), such as a condo/townhome/detached house. Pay attention the specific type of property you are wanting to purchase as each of these units have are their own market.

Generally, when interest rates are at their highest (such as last November/December/January) volume of sales (units sold) were at their lowest, leading to less competition and lower prices. Of course, this is most noticeable on the higher-end of the price range where the amount of buyers is the smallest.

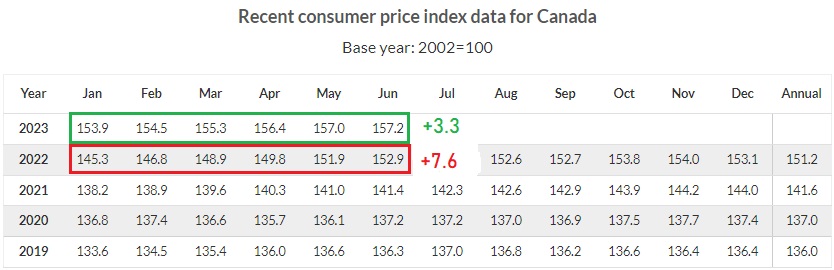

Based on the recent rate increases we are setting up for another slow-down in the second half of the year, especially if the Bank of Canada raises rates again on September 6th.

Should you decide to purchase when interest rates are at their highest and volumes are at their lowest, understand this will likely be the time you will get the best price, but it will also be the time you will be paying the highest mortgage costs.

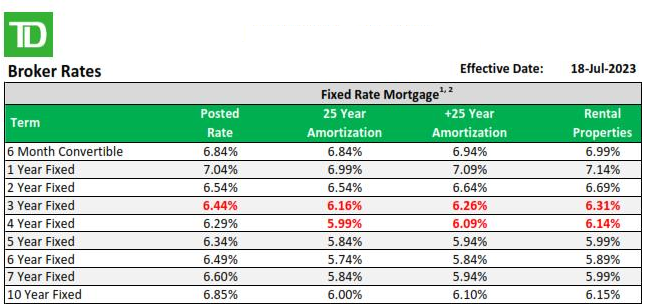

In this situation, it is better to go with a shorter term loan (1-yr/2-yr) even though it will have a higher payment than the 5-yr fixed. After your term is complete you will *hopefully* be able to renew into a much lower interest rate. Then you will have bought at a great price and a ultimately have a lower-rate mortgage when viewed over a 5-yr timeframe.

In Vancouver, it is virtually impossible to receive a low-mortgage rate and a low-price on a home. If you can afford it, I feel it is better to receive a low-price on a home and pay a higher mortgage rate instead of receiving a low-mortgage payment and paying a higher price.

The reason I believe this is simple, when rates decrease you immediately see home prices increase, and as home prices increase your home equity also increases.

For example: Lets say someone who’s shopping for a home can only qualify for a property for $750,000 when mortgage rates are at 5.34% this will create $ 4,313/m payment. If rates drop to 4.34%, that same person would now be able to qualify for a purchase price of $825,000. This puts pressure on sellers to increase their home price as they know their home is affordable to a larger market.

Now, if the person had purchased the property for $750,000 and in 3-yrs time their home is now worth $825,000, they would have an additional $75,000 in owner-equity, and only paid $14,580 in extra interest.

I came up with $14,580 by taking a the additional interest charged on a 3-yr mortgage payment on $750,000 purchase price at an interest rate of 5.34% vs 4.34% ($4,313 – $3,908 = $405 x 36 months)

How to Prepare for this?

If you are trying to time the market I suggest putting in a Pre-Approval before interest rates raise again. This way you can hold an interest rate for 120-days (until November 18).

Fixed mortgage rates typically start climbing 2-3 weeks before the Bank of Canada’s rate announcement.

Contact me today and lets setup a rate-hold so you’re prepared for whatever comes this fall.

|

|

|

|

|