Forecasting the Inflation Rate for 2024

Here is a simple way to forecast the inflation rate for 2024 – conservatively, of course.

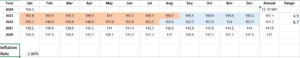

First, grab the CPI data from Rateinflation.com and paste it into an excel sheet.

Then, look for some patterns in these numbers. Notice how the CPI numbers change from one month to the next.

I noticed CPI data increased A LOT 🚀 in the first half of the year, but then remains relatively flat in the latter half.

Next, I subtracted the CPI highs and lows within each year to determine the range.

2022 had a range of 8.7 (145.3 – 154)

2023 had a range of 4.9 (153.9 – 158.8)⬇️

This tells me the rate at which CPI is rising is trending downwards.

A conservative forecast would then mean we expect a similar range to last year (4.9).

I then used CPI from January (158.3) as my base for the year and assumed by August we’ll see CPI increase by 4.9 to 163.2. I also assumed CPI would then remain relatively flat from August to December. (Similar pattern to the last 2 years).

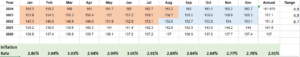

Now that we have our data, we can find the inflation rate. Apply the following formula: (Month 2024-month 2023)/month 2023

Example: (January 2024 – January 2023) / January 2023

= (158.3 – 153.9) / 153.9

= 2.86%

After doing this exercise I was pretty surprised to see this forecast was in-line with the Bank of Canada’s projections:

“The Bank projects that inflation will stay around 3% through the first half of 2024, returning to target in 2025.”

This is a pretty fun exercise to try, very curious to see what actual numbers look like in the coming months 👀