Where are BC’s Housing prices going? Up or Down?

I believe this graph holds the answers…

Canada’s new housing units to growth in working age population

*Disclaimer* – I am from Vancouver, British Columbia and my bold prediction of double digit price increases is meant for Metro Vancouver Condo’s, NOT Canada as a whole.

THIS GRAPH TELLS US..

For every 1-housing unit being created, there are 5 people entering the Canada’s working-age population.

Working-age population is defined as anyone turning 15, or entering Canada who is +15.

The last time we saw a similar housing deficit was in 2008, but the economics were different..

INSIGHTS

During the 2008 financial crisis developers pressed pause on their building projects. This created a lack of development and housing for the future.

BC Housing Start History

BC’s real-estate market didn’t feel this lack-of-supply until 2014 and 2015.

This is when everyone who had reached the age of 15 in 2008-2010, was now 19-22 years old and moving out of their parents house.

In 2014, 2015 and 2016, the province of BC experienced housing price growth of 5%, 11% and 8.6%.

In Vancouver the price growth was even higher.

The lack of supply was created primarily from a lack of development from 2008 to 2015.

CURRENT TREND

Today, we are in a different situation. We are dealing with massive immigration and, in my opinion, I believe the demand will hit the real-estate market much quicker than what we experienced from 2008 to 2015. As 64% of everyone coming to Canada is between the ages 25-54.

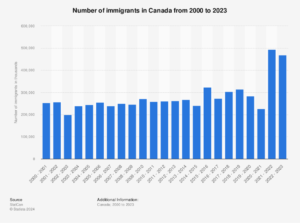

Canada’s Immigration History

Over the last 3 years developers in BC are building at an excellent pace. Averaging close to 50,000 housing units a year.

Unfortunately this is not enough. According to CMHC forecasts, BC needs to increase production to 80,000 units per year to keep up with demand due to population growth.

Thanks to higher interest rates over the last couple years, and coming off of insane price growth from 2020 to 2022, we are technically experiencing a lull in the Metro Vancouver Real-Estate Market.

Sure, it may not feel like this is a “lull,” but just wait until this pent-up demand comes back to the market.

Here are the main things we expect to kickstart the Metro Vancouver’s Real-Estate market:

- Rate cuts in the 2nd half of 2024, and throughout 2025 and 2026

- High Immigration -> which leads to increasing rental prices-> which leads to people being fed up with renting and deciding to purchase.

- Lifting of foreign buyer ban January 2027 <- Hopefully this will be delayed again..

The Benchmark prices for Metro Vancouver from April 2022 to April 2024 have DECLINED as follows:

- Detached Home: -4.8%

- Townhomes: -2.1%

- Apartment: -8.7%

I believe apartments will make the strongest rebound in prices, as this is the largest market for first-time home buyers and property investors.

BOLD PREDICTION

I believe we will see double digit price increases on Metro Vancouver apartments in the next 12-18 months.

Every rate cute will unlock increasing demand from buyers, with many of them being First-Time Home Buyers.

According to TD’s Top Economist, Derek Burleton, we’ve experienced an economic soft-landing due to rising interest rates, and when interest rates begin decreasing (likely July 2024) we will experience a soft-take off.

Metro-Vancouver Real-Estate generally moves much quicker than the rest of Canada, so it will be interesting to see how long it takes for momentum to build in one of the top liveable cities in the world.

I’d love to hear your thoughts, what do you think is brewing in the Vancouver/BC housing market?

Adam Sale

Mortgage Broker – Sale Mortgages

Phone: 778-215-4121