Accelerate Your Net Worth!

Now that you own a home, and you’re making regular payments on your mortgage do you have a financial plan to grow your Net Worth efficiently?

In this blog, I’ll highlight 3 competing options to help you Accelerate Your Net Worth!

Keep in mind, each of these options has a different risk level. It is recommended you chat with a financial planner and a reputable mortgage broker to develop a plan matching your risk-tolerance.

1) Pre-Pay Your Mortgage – Risk: Low

Paying off your mortgage as quickly as possible is the simplest way to reduce the amount of interest you pay on your mortgage, and increase your net worth. Every lender offers their unique pre-payment options, allowing you to make extra payments on the balance of your mortgage. Each prepayment reduces the amount of interest charged on the balance of the mortgage, effectively paying off your mortgage faster. I’d argue this is the least risky option and the most stable.

2) Invest in the S&P 500 index fund – Risk: Medium

Instead of sinking your hard-earned money into your mortgage, have you considered your money and investing in the S&P 500 index fund? This option has a greater amount of risk, greater upside potential and keeps your money easily accessible.

Your goal with investing, is to achieve an average growth rate on your investment that is higher than your average mortgage rate. Be prepared by anticipating high growth years and low growth/loss years as you go through several economic cycles. If you can achieve a greater average annual growth over a long period of time, your investments will outperform the Pre-Payment Option. Before investing in a fund, do some research and chat with a financial advisor.

History does not predict the future, but there is some comfort in seeing previous rates of return.

S&P 500 Average Rate of Return (Source)

- 5-yrs: 14.87%

- 10-yrs: 12.86%

- 20-years: 10.47%

- 30-years: 10.733%

- 50-years: 11.86%

3) Smith Maneuver / Creating a Tax-Deductible Mortgage – Risk: High

The final option, and the one that carries the greatest amount of risk, is using a technique known as the Smith Maneuver.

This is an advanced technique with better upside potential for those of you in a higher tax bracket. The goal behind this technique is converting your mortgage into a tax-deductible expense over a period of 7-10 years. This is a hands-on technique, and is recommended for those who know there way around their online banking website.

Converting your mortgage into a tax-deductible expense is achieved by borrowing from your Home-Equity Line of Credit and using these funds to invest into dividend paying stocks or index funds. Because the loan is being used to purchase income producing investment, the interest on the loan is tax deductible.

The higher your tax bracket the larger your tax refund will be.

Smith Maneuver strategists apply their annual tax refund as a pre-payment on their mortgage. Then, they’ll reborrow this amount from their Home-Equity Line of Credit and purchase more investments. The cycle continues until the entire mortgage is tax-deductible.

If you are in a higher tax bracket, consider using the tax system to your advantage with the Smith Maneuver.

Summary

I’ve outlined 3-different options to accelerate your net worth, but how will you know which one to choose?

Wouldn’t you like to see the numbers from each option before deciding which path is best for you?

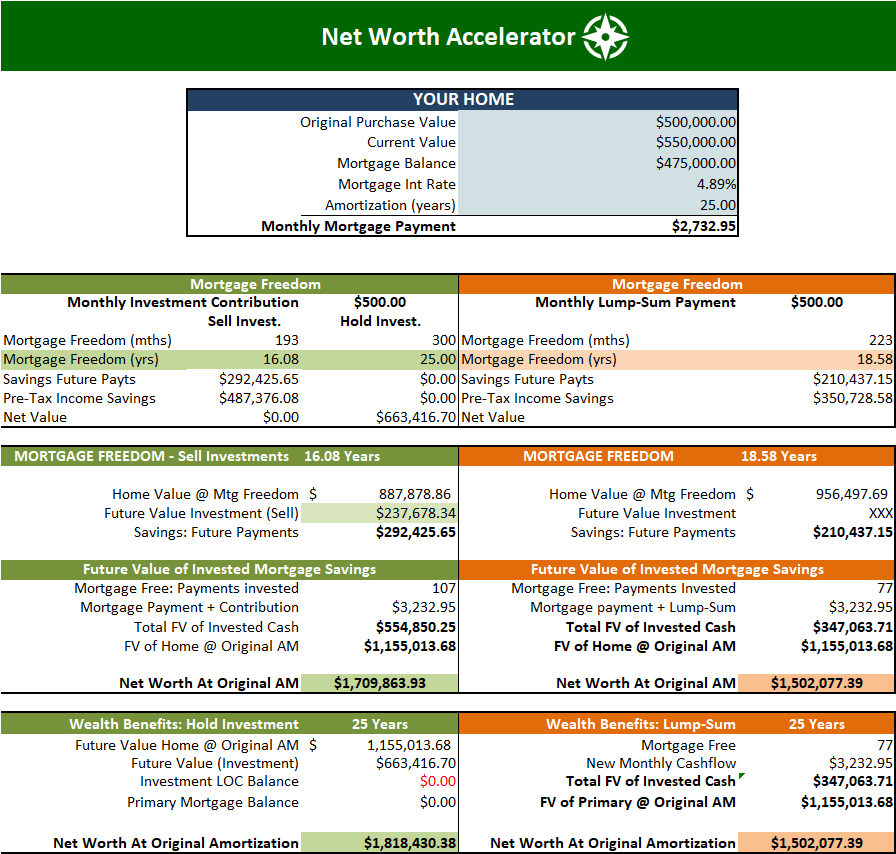

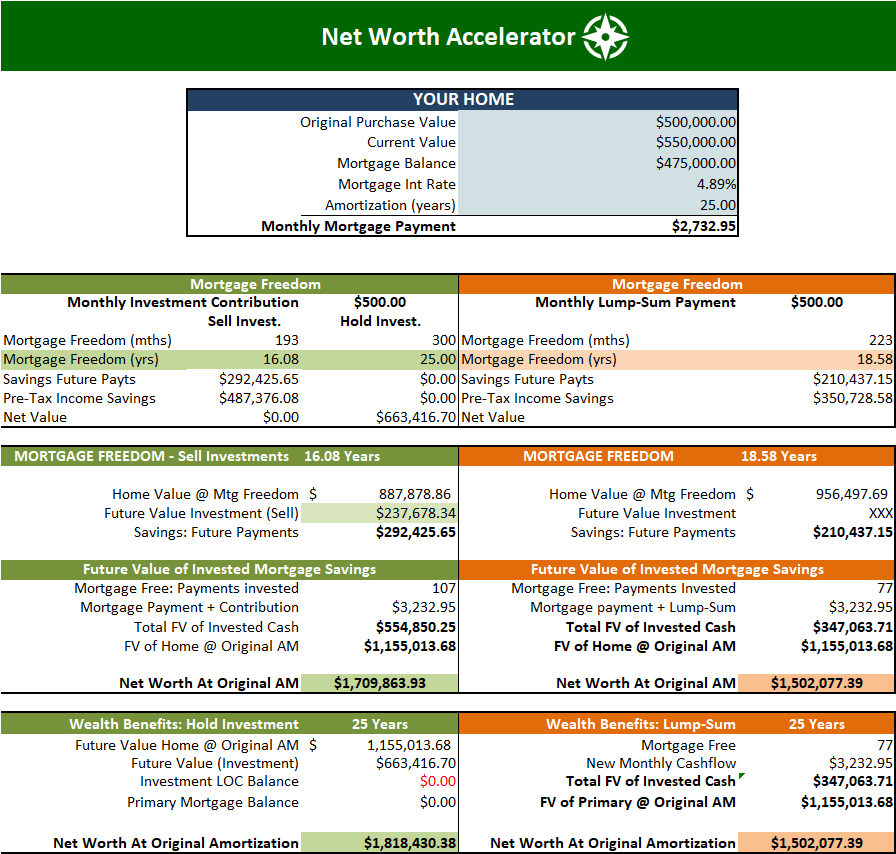

This is why I’ve created the Net Worth Accelerator Blueprint.

Using REAL numbers from your current mortgage, you’ll receive a custom blueprint highlighting your accelerated Net Worth based on 2 financial strategies: Investing or Pre-Paying your mortgage.

My goal with the Net Worth Accelerator is to provide you with better information so you can decide if the risks are worth the rewards.

Net Worth Accelerator Blueprint

Do you want More Out of Your Money?

Click the link to complete a mortgage questionnaire and I’ll provide you with your custom Net Worth Accelerator Blueprint

Get Your Custom Blueprint here: Net Worth Accelerator Blueprint

Adam Sale

778-215-4121