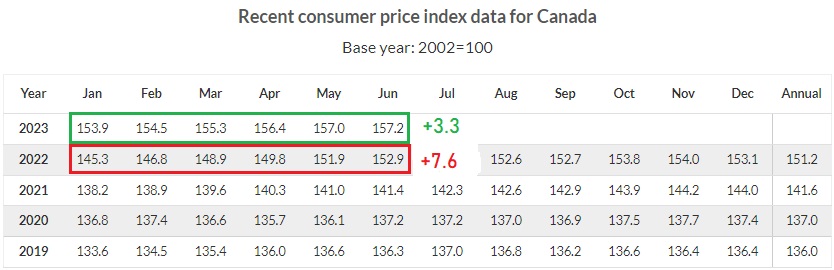

Great news!! The Consumer Price Index report (inflation report) was released today and shows inflation slowing to 2.8%. Over the last 6-months (January to June) the CPI index has only ticked upwards by 3.3 points as opposed to 2022 January to June’s CPI index increase of 7.6%.

This is an excellent sign, but we’re not out of the weeds yet. We still need to see the unemployment report released on August 4th showing the unemployment rate increasing. It is very possible we won’t get the news we’d like on August 4th as high-schoolers will now be out of school, and will likely be looking for part-time work.

Looking at the numbers, it appears we are going to hit our targets in November/December. If this is the case, *hopefully* we will see some rate relief in Q1/Q2 of 2024.

Bank of Canada Petition to Pause Interest Rates

The Bank of Canada stated they are considering rates another 0.25% in September, or later this year. After speaking with many past clients it seems these rate increases could be enough to push many Canadians over the edge.

Over the last 18 months, interest rates have increased by 4.75% and it appears to be working to slow inflation, but when is enough-enough?

I created this petition to help Canadians voice their concerns that they Bank of Canada needs to pause (or lower) interest rates, and wait for these rate increases to have their full effect on the economy.

If you would like to see the Bank of Canada pause their interest rate hikes, please consider signing this petition.

If you have any mortgage related questions, please contact me at:

Adam Sale Mortgages

adamjsale@gmail.com

778-215-4121