Pre-approved Mortgage Before Interest Rates Increase

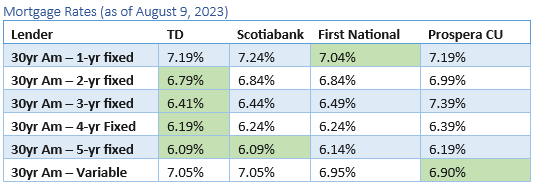

Are you aware of the current trend in rising interest rates among lenders? It’s a direct response to the anticipated rate hike by the Bank of Canada scheduled for September 6th.

As the real estate market transitions into the fall season, there’s an expectation of a slowdown. This slowdown is attributed to the impending expiration of pre-approvals in September/October.

For potential buyers who have yet to make a purchase, there’s a critical need to reapply for rate holds. However, the new rates will be +1% higher than the rates secured since May. This adjustment could lead to a reduction of purchasing power by approximately $50,000 or more, and an increase of around $300 in monthly payments.

The consequence of this situation could temporarily decrease the overall transaction volume. On the flip side, it presents an advantageous moment for buyers to secure favorable prices on new homes.

If your plans involve property acquisition within the next half-year, I strongly recommend taking the step of obtaining a pre-approval or rate hold. By doing so, you’ll have a safeguard in place in case you come across a property that catches your interest – particularly if the seller is motivated to close the deal.

The imminent increase in the Bank of Canada’s variable rate, expected on September 6th, will likely contribute to further hikes in fixed rates.

Anticipate an influx of one-bedroom and two-bedroom rental properties entering the market throughout the fall. Many investment properties acquired after 2016 are no longer yielding profits and their management costs have become burdensome.

As these property mortgages reach their renewal periods, investors might find themselves lacking the necessary cash flow to accommodate these rate hikes. Consequently, some may opt to liquidate portions of their investment portfolios.

Ready to take action? Complete our Mortgage Application to start the process.

The pre-approval/rate-hold process is streamlined. We require a completed mortgage application to facilitate the communication with lenders. This allows you to secure an interest rate for an extended period of 120 days, up until December 7th.

Here’s what you need to know:

- If you finalize a property transaction within the 120-day rate-hold period, you’ll secure the rates we’ve held or potentially even better.

- If your property purchase is set for January, we can utilize the rates available 120 days prior to completion.

- Should your property search yield no results during this timeframe, the expiring rate hold won’t significantly impact your borrowing prospects. It also provides the opportunity for us to resubmit the rate hold as you continue your search.

Ready to move forward? Begin with our Mortgage Application now.

In case you have inquiries or wish to explore your financing eligibility, feel free to reach out directly at 778-215-4121.