Is it better to go with a Fixed Rate Mortgage or a Variable Rate Mortgage?

The Bank of Canada’s decreased the Prime Rate for the 3rd time last week, which is re-igniting the question above.

Over the past 24-months, the 3-yr fixed-rate has risen in popularity over the 5-yr Variable rate and the 5-yr fixed rate mortgages, primarily because:

- Rates were the highest they’ve been in 20 years ,and it didn’t make sense to lock-in for 5-yrs.

- The difference between the 3-yr fixed rate and the 5-yr fixed rate was very small (0.20%), and so paying the premium for a shorter-term mortgage with the expectation of renewing the mortgage 2-yrs earlier at a lower rate is easily justifiable.

- The 5-yr variable rate is 1% higher than fixed mortgage rates.

As of Wednesday last week, the Bank of Canada lowered the variable interest rate for the 3rd time, bringing the Prime lending rate down to 6.45%.

Many Economists predict we will see the Prime rate to drop to 4.7% by the end of 2025 – a further decrease of 1.75%.

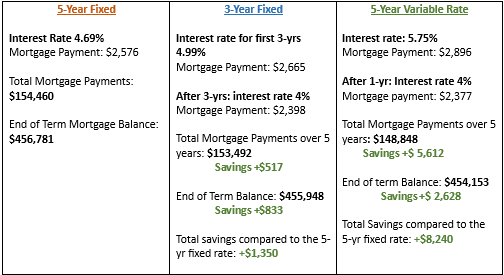

Considering the mortgage rates listed below, we ask ourselves, “is it better to go with a variable-rate mortgage or a fixed-rate mortgage?”

- 30-yr Conventional 5-yr Fixed: 4.69%

- 25-yr Insured 5-yr Fixed: 4.44%

- 30-Yr Conventional 3-yr Fixed: 4.99%

- 25-yr Insured 3-yr Fixed: 4.74%

- 30-yr Conventional Variable Rate: Prime – 0.70% (5.75%)

- 25-Yr Insured Variable Rate: Prime – 1.00% (5.45%)

Let’s do a quick dollar-to-dollar comparison. We’re not going to consider lifestyle changes or potential future moves. We are only focusing on the costs of each mortgage as if it is held until completion.

To compare each option, we need to ASSUME future interest rates of the variable and fixed mortgages.

Assuming future interest rates opens us up to risk, but for the sake of this analysis let’s assume:

- By the end of 2025 (1-yr), Prime rate decreases to 4.70%.

- In 3-yrs time (October 2027) interest rates are at 4.00%

These mortgage products are compared over a 5-yr period

Variable vs fixed

Conclusion:

Forecasting interest rates is virtually impossible to achieve correctly – just think of how high interest rates climbed over the last 2-years. At the beginning of 2022, not a single economist predicted Prime Interest Rate would increase by +4.75% in the year that followed.

A better alternative too predicting the future economy, is to focus on your personal 3 – 5 – 10 year plan, and then find a mortgage aligning with your plan.

Ask yourself these questions:

- Can you see yourself living in this for the next 5-years?

- Would your home support a growing family?

- Would you move city/provinces if the right job opportunity came?

- Do you know what is a better fit for your plan, paying off your mortgage quickly or investing?

- Is your financial profile optimized for the most tax savings?

If you have any questions, or would like me to run a specific scenario for you, please reach out with the details and I can help.

All the best,

Adam Sale

778-215-4121