2025 Predictions – Interest Rates, Housing, Immigration & Tin-Foil Hats

First of all, I’d like to wish you a very Happy New Year, let’s make 2025 your best year yet!

I’d like to start a new tradition this year by making some bold predictions. At the start of next year we’ll revisit these predictions and see if any came true!

Let’s get into it!

Fortune teller

2025 Prediction #1 – Canada’s BOC Rate will decrease another 1.25% by September

Last year, National Bank’s economist read the economic tea leaves correctly and were the only bank to predict the Bank of Canada would decrease the interest rate by 1.75%.

This year, National Bank is predicting the Bank of Canada will lower the Prime rate an additional 1.25% by the end of Q3. This would bring the Prime Rate down to 4.45%.

If this holds true, many variable rate mortgages could be in the 3.45% – 4.00% range by summer.

I’m going to piggy-back on National Bank’s prediction. I highly recommend reading their Economic Report for a better understanding of why they believe this is the case. You can check it out HERE.

In regards to Fixed Rate Mortgages, I believe we’ll see insured rates decrease to 3.79% – 4.25% by summer.

I don’t believe we’ll see interest rates go much lower than 3.79% in 2025, and it’s too far early to tell what 2026 holds.

2025 Prediction #2 – Vancouver’s Housing Prices will Trade Flat Throughout 2025

My big prediction for Vancouver’s housing market is we’ll continue seeing more inventory, more sales, and the median housing prices will remain relatively flat in the Vancouver.

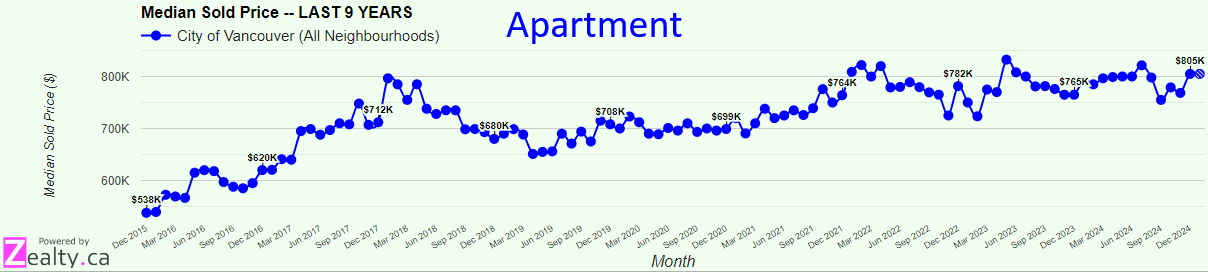

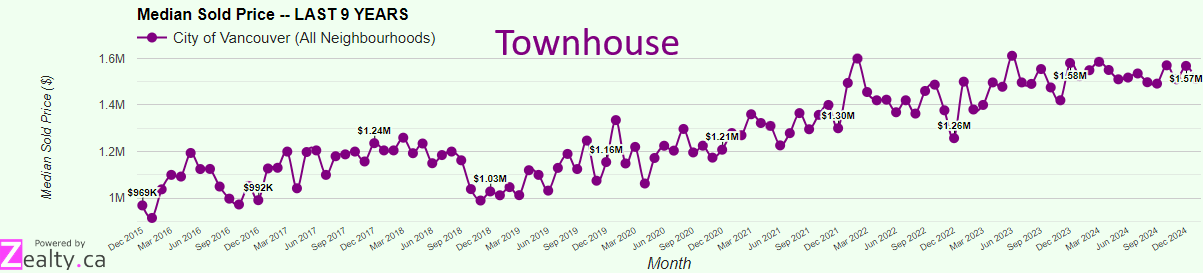

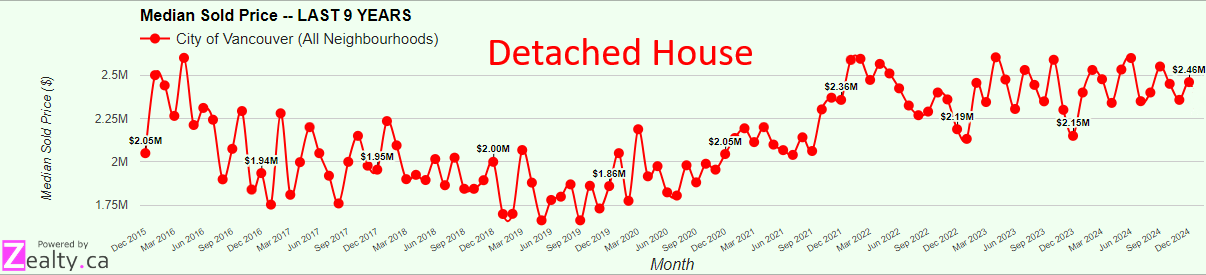

These predictions are tough to make because prices fluctuate month-to-month. So here’s a couple graphs to give you a better idea of what I mean when I say relatively flat.

Apartments: Median Sold Price in City of Vancouver will increase from $805k to $815K in December 2025

Townhouses: Median Sold Price in City of Vancouver will increase from $1.57m to $1.65m in December 2025

Detached Houses: Median Sold Price in City of Vancouver will increase from $2.46m to $2.60m in December 2025

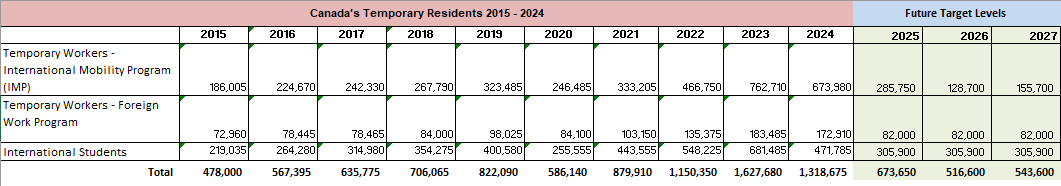

2025 Prediction #3 – Immigration Levels will Remain Unchanged

With JT stepping down, Canada is expecting a federal election this summer. My prediction is the new leadership (Conservative or Liberal) will maintain the Immigration Plan proposed in October 2024.

The Immigration Plan will bring Temporary Resident targets back to levels not seen since 2015. I believe the new leadership will keep this plan unchanged in 2025.

If this holds true, we’ll continue seeing strong demand for housing and a lack of supply. The housing crisis won’t be fixed overnight, which means housing prices should remain flat for most of the country.

2025 Prediction #4 – Tin-Foil Hat Prediction – Canada is not joining the US

Trump certainly knows how to press those emotional buttons… right before hitting the negotiating tables.

This is my tinfoil hat prediction, but I believe what Trump really wants is control over the global shipping arena.

He’s either going to get this through a trade deal with Panama, or Canada.

Canada has the North-West Passage, which has the potential to disrupt global shipping routes by being a serious competitor to the Panama Canal.

As with most things in Canada, this Passage is relatively unused today.

My tinfoil hat tells me the North-West Passage is going to be a key bargaining chip when Canada and the US sit down to discuss tariffs.

If you’d like to learn more, here is a great paper on the Northwest Passage https://scholarship.law.nd.edu/cgi/viewcontent.cgi?article=1206&context=ndjicl

I hope you enjoyed these predictions!

Do you know anyone who would benefit from unbiased mortgage advice?

I would appreciate an email introduction – adam@salemortgages.ca

Best,

Adam Sale

778-215-4121