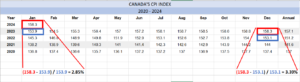

Inflation is down to 2.85%, but CPI remains 158.3Last month I sent an email showing why inflation had increased even though CPI number had decreased. And now today’s inflation report shows inflation decreasing, but the CPI number remains the same as last month, why is this happening? To explain this better, let’s do a quick recap on how to calculate inflation. Inflation Rate: The rate-of-change on prices of goods, and the prices of goods is represented by the Consumer Price Index (CPI). Inflation Rate = (Current Month CPI – Previous Year’s Month CPI) / Previous Year’s Month |

Image of Canada’s CPI Data from 2020 to 2024

Economic Market Report

The inflation rate decreasing is awesome news and we are already seeing bond yields correcting from the recent run-up.

However, we are still a long ways away from the 2% target, and personally I’d be shocked if we saw the Bank of Canada decrease interest rates before July

On February 29th, the Q4 GDP Report is being released and this will likely show the economy outperforming the Bank of Canada’s original expectation due to a strong December.

A stronger-than-expected GDP Report will cause the bond yields to spike upwards momentarily. Any refinances or purchases should get their pre-approvals/rate holds in ahead of time.

The Royal Bank released a statement regarding the upcoming GDP Shock: (Read this)

Bottom Line: The reacceleration of growth towards the end of 2023 should be taken with a grain of salt – early GDP estimates are revision-prone and a lot of the strength in November was due to one off factors such as recoveries from earlier factory shutdowns and strike activities that are unlikely to be repeated in the following months.

Taking the advance December estimate at face value, growth in Q4 is tracking an annualized increase of 1.2% which is above our tracking for a small decline. That however would still mark a sixth consecutive quarterly decline when growth is counted on a per-capita basis, as population growth continues to surge. Overall we continue to expect pressures from elevated interest rates to curb consumer demand, stalling growth in both output and inflation over the first half of 2024 before the BoC is expected to cut rates in June.

Summary:

It seems we are still heading towards an economic slowdown even though the GDP report will likely be stronger-than-expected on February 29th.

Get your pre-approvals on purchases, renewals or refinances in before February 29th as we may see interest rates spike after the GDP Report is released.

Adam Sale

778-215-4121