Turning Tariff Turmoil into Triumph

The looming impact of tariffs will cause much discomfort for all British Columbians, but if you look hard enough, you can find the opportunities.

- Variable Rate Mortgage Holders

- BC’s “Tariff Proof” jobs

- Where is the Opportunity?

Variable Rate Mortgage Holders

Variable rate mortgage holders face a period of optimism. At the beginning of the year, financial institutions anticipated the Bank of Canada would reduce interest rates by 0.75% to 1.00%, to bring us back to our neutral target following a period of inflation control.

However, the recent implementation of tariffs by the United States has introduced a significant variable, necessitating an economic growth monetary policy response.

Banks are now recalibrating their forecasts, with some predicting interest rate cuts exceeding the initial projections. The Bank of Canada may need to implement interest rate reductions in the range of 2.00% to 2.50% to stimulate economic activity.

This scenario could potentially bring variable mortgage rates down to the 2.00% – 2.50% range.

Tariff Proof Jobs in BC

While tariffs and retaliatory measures will broadly influence consumer goods and services, a significant portion of British Columbia’s workforce remains relatively insulated.

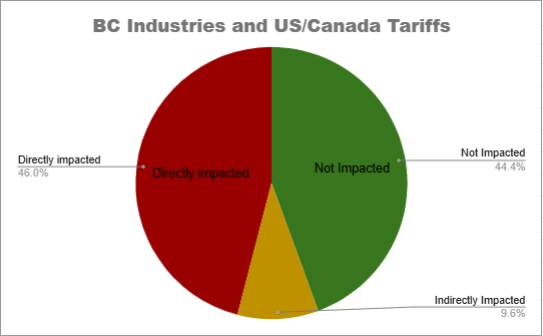

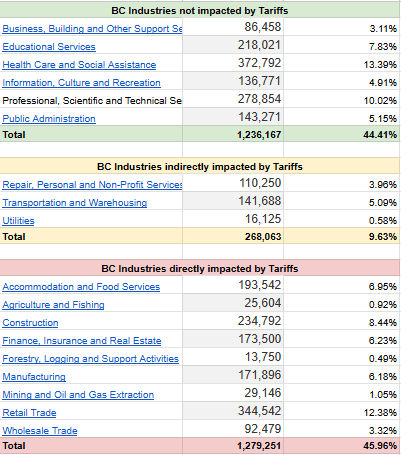

Approximately 45% of BC’s employment is projected to be unaffected by reciprocal tariffs, with an additional 10%experiencing indirect impacts.

Conversely, 45% of industries face direct exposure, potentially leading to decreased activity and job losses. The following breakdown provides a comprehensive overview of BC’s industry sectors and their respective market shares.

Where is the opportunity?

The impact of tariffs on construction, including rising material costs and slowed development, creates a unique housing market dynamic. The potential for lower interest rates, coupled with reduced competition, presents a compelling opportunity for buyers employed in recession-resistant sectors such as, healthcare, accounting, legal, and public services.

Conclusion

British Columbia’s economic stability hinges on the imminent resolution of trade uncertainties.

The next few weeks are critical, as the US Trade Deficit Inquiry report is due on April 1st, followed by the unveiling of a tailored tariff plan on April 2nd.