Your Buying Power Increased by 9%!

If you are thinking about purchasing or selling your home in the next year, you need to understand the importance of the upcoming CMHC policy changes.

As of December 14, 2024 – First-time homebuyers purchasing with a down-payment less than 20% will see their purchasing power increase by approximately 9.00% due to the government increasing the amortization for these mortgage products from 25-years to 30-years.

Why is this significant?

According to CMHC’s 2023 Survey Pg 8 (SOURCE)

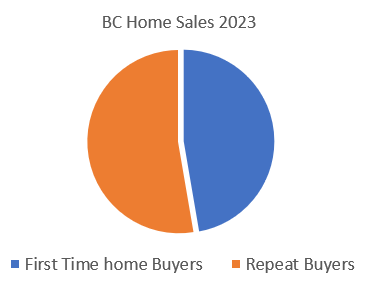

First-Time Home Buyers make up 54% of all purchases in Canada. This is slightly less in BC, at 47.3%

First time home buyers to repeat buyers.

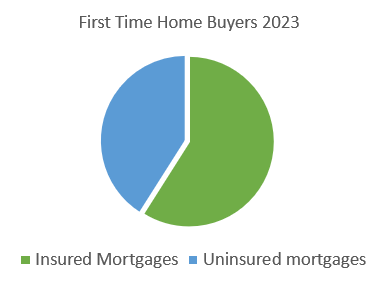

Of these sales, 59% of First-Time Home Buyers used the insured mortgage product.

Insured Mortgages to Uninsured Mortgages

Meaning, 28% of all Home Buyers in BC will see their buying power increase by 9% after December 14th, 2024.

For example, a first time home buyer qualified to purchase a property for $600,000, will now qualify for a purchase of $654,000.

In response to the upcoming changes, sales activity is increasing in the lower-mainland and a floor on housing prices appears to be setting in.

Home sales in Greater Vancouver increased by +30% in the month of October.

- September Home Sales: 1,852

- October Home Sales: 2,632

If this trend continues, we can expect a busier spring market.

Feel free to reach out if you have any questions.

Best,

Adam Sale

778-215-4121