Bank of Canada held rates at 5% – Prime Rate remains at 7.20%.

Inflation continues to decrease, and we should be within the Bank’s 2% inflation target range in a couple months.

The higher rates are having a negative impact on the economy and cracks are beginning to form:

- Third quarter GDP numbers show the economy contracted by 1%.

- Unemployment numbers are continuing to trend higher, currently at 8%

It feels like we are setting the stage for a mild recession in 2024.

The biggest challenge with this recession will be the speed at which the Bank of Canada can lower interest rates without increasing inflation.

Economists are predicting we will see the first round of rate cuts as early as March. Personally, I feel this is too optimistic. I am leaning towards the first round of rate cuts in June/July 2024.

The longer the Bank of Canada can put off the rate-cuts, the better chance we have of keeping inflation at bay.

Some relief is on the horizon!

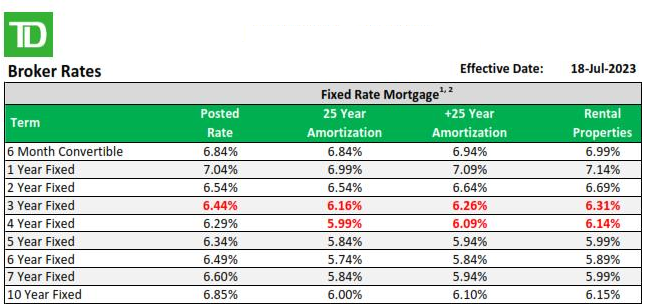

Mortgage Update:

We are getting weekly updates from lenders with lower rates. The rates you are quoted today will likely be lower 1-month from now.

If you have a renewal coming up, please let me know

I will send you a list of market rates, and where we expect them to be when you renew.

The variable rate remains unchanged. Economists expect the Bank of Canada to decrease the variable rate by 2% over the next 2 years.

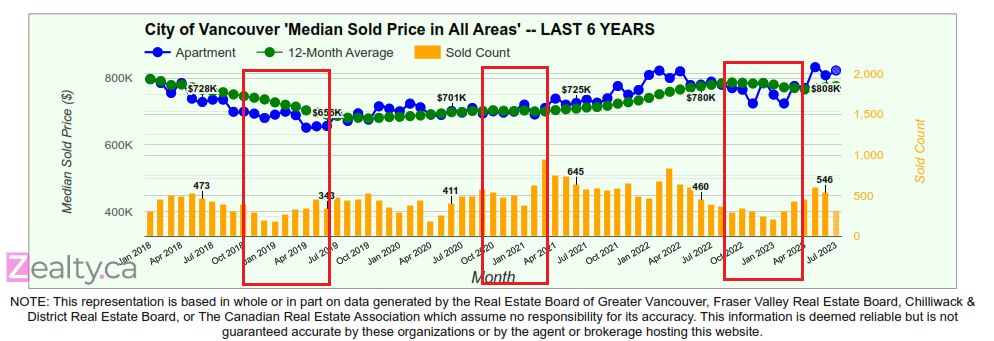

Vancouver Real-Estate:

The lower-mainland naturally slows down in December as buyers naturally shift their focus to the holiday season.

There is no better time than the holidays to find a deal as many buyers are too pre-occupied to be going to open houses on the weekends.

Don’t expect this lull in the market to last long.

As soon as middle of January comes the Spring Market quickly picks up speed. When the lower rates hit mainstream news we will have a recipe for a very busy market in 2024.

East & West Vancouver have shifted into a Balanced Market.

North Vancouver is still a Seller’s Market.

In my next email I will provide you with some common themes to housing prices during a recession – it’s not what you think!