Liberal Government Re-Elected – Recap on Housing Plan

Congratulations to Mark Carney and Pierre Poilievre on their election results, it was a hard-fought battle on both sides!

Here is a recap of the Liberal’s housing plan:

- Commitment to double the pace of housing construction to 500,000 homes annually, leveraging innovative technologies and public lands

- Establish Build Canada Homes entity to: act as a developer and manage projects and partners with builders during the construction phase. BCH is also tasked with acquiring land wherever possible and offer leases to add to Canada’s affordable housing stock

- Proposal to cut municipal development charges in half for multi-rent housing for three years to lower construction costs

- Plan to reintroduce tax incentives for rental housing construction, called Multiple Unit Residential building (MURB) to stimulate the building of rental units.

- Eliminating GST on homes under $1,000,000

Let’s break it down

Commitment to double the pace of housing construction to 500,000 homes annually in the next 10-year, leveraging innovative technologies and public lands.

Canada’s highest year of housing starts was in 1976 with 273,203 homes, and the 2nd highest year was in 2021 with 271,198.

Doubling Canada’s housing production is a tall order, but if the ideal circumstances appear, it may be possible.

The Housing Plan highlights pre-fabricated homes is the solution.

There are currently 320 pre-fab manufactures in Canada. The largest manufacture, Caivan, reports building 5-7 homes per day.

If Government investment in the prefabricated industry can boost housing production of these other companies to an average of 2 homes per day, the pre-fab housing market has potential to supply:

2 homes/day x 365 days x 320 manufacturers = 233,600 homes/yr.

Although this doesn’t hit the mark, if factored in with other multi-unit housing initiatives, it certainly comes close.

Build Canada Homes entity

According to the Housing Plan, the establishment of Build Canada Homes entity is tasked with the following:

- build affordable housing at scale

- acquire additional land

- offer leases

The Build Canada Homes entity will provide $25-billion in debt financing and $1-billion in equity financing to pre-fabricated and modular home builders to grow their capacity – build more homes.

In addition, they plan on offering cheaper, leased land to develop Canada’s affordable housing stock.

Proposal to cut municipal development charges in half for multi-unit residential housing for 5-years to lower construction costs

Cutting costs on construction should help developers break ground with many of their projects. For example, this savings would result on average $25,000 per unit in Vancouver. On a development of 200 units, the savings could be roughly $5,000,000, which could help offset the increased tariff costs on steel and aluminum used in construction.

On the front-end, reducing the costs required to apply for a permit and shifting the costs further down the pipeline to the construction phase should encourage developers break ground and build more units.

On the back-end, I am curious if the federal government will shift some of these tariff revenues to municipalities to offset their lost revenue from building permits.

Plan to reintroduce tax incentives for rental housing construction to stimulate the building of rental units (MURB).

The tax incentive referred by the plan allowed investors to deduct construction related expenses, including depreciation, from their personal income tax effectively offsetting potential losses. This is a unique incentive that comes at a time when developers need it most.

The number of developers facing receivership is the highest it’s been since 2008, and this incentive could help alleviate some of that pain.

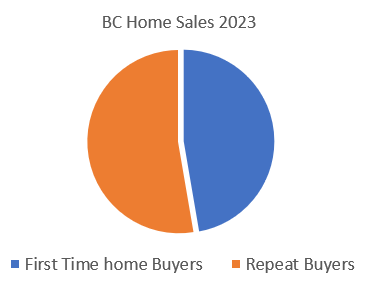

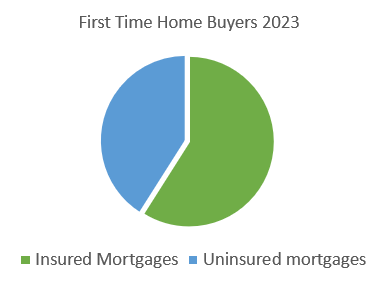

Eliminating GST for First-Time Home Buyers on New Homes under $1,000,000

This is an excellent incentive for First-Time Home Buyers and a once-in-a-life-time opportunity. In the past the government has offered GST rebates, but never a full exemption, and certainly not for home values up to $1-million.

In Vancouver, we are seeing many appraisals come in lower-than-expected on new home purchases, often requiring the owners to pay the extra GST costs in cash.

Removing the GST on these homes for First-Time Home Buyers, should help move much of the newbuild 1-bedroom and 2-bedroom housing stock in GVA, and save purchasers a large GST cost.

Final Thoughts

The Housing Plan has some lofty goals, while providing great ideas and incentives for combating Canada’s housing crisis.

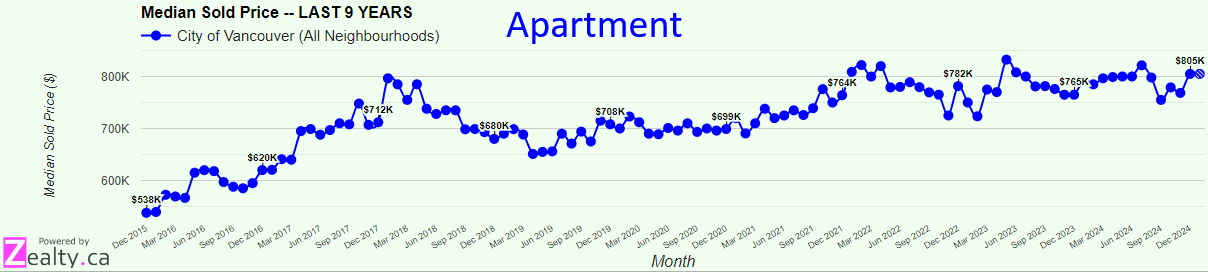

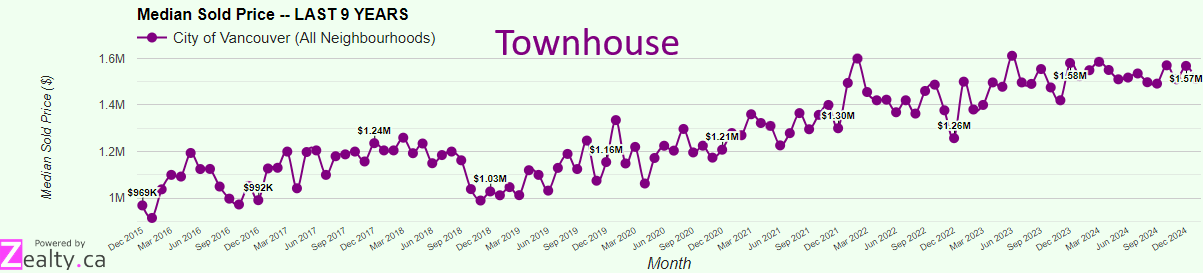

Here’s the trend I see in the housing market:

- Easier & cheaper pathway forward for developers to build purpose-build rental housing units will incentivize more rental unit projects, likely overtaking other housing projects.

- Government is expecting to finance a boom in the pre-fabricated housing market, lowering costs of production and then supply cheap leased land to the market. Reducing housing costs and providing the illusion of homeownership, but still retaining control over the land.

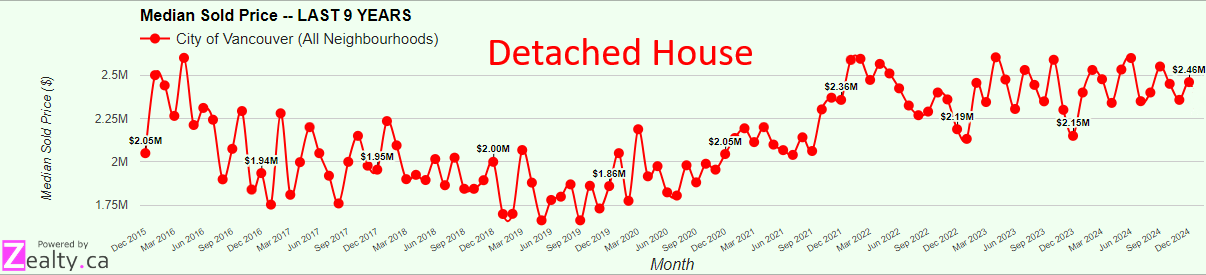

- Less construction of homes for actual homeownership will put upward pressure on housing prices in the near future.

Do you have a home financing question I can help with? Send an email or call me at 778-215-4121, I’d happy to help.

Best,

Adam Sale