Big Changes for ALL Mortgage Holders:

More Competition & Better Savings!

Last week Canada’s Banking regulator (OSFI) announced they will be removing the stress-test on ALL mortgage renewals as of November 21, 2024.

The stress-test has been the main culprit in hand-cuffing many mortgage holders to their current lender.

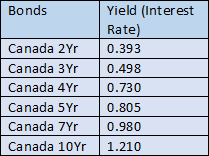

The old rules require anyone switching mortgage lenders to requalify for their mortgage amount using the stress-test rate. The stress-test rate is the Mortgage Rate + 2%.

Over the last 2-years, many borrowers were unable to switch lenders because they were unable to income qualify for their current mortgage amount. The mortgage rate was too high, and the added 2% stress-test made it virtually impossible.

Borrowers in these circumstance were forced to accept whatever rate their lender provided them at renewal. Often times these rates were MUCH higher than the current market rates.

Unfortunately, this rule should’ve changed 2-years ago when interest rates were steadily rising.

The changes to this policy is an excellent step forward as it forces the banks to remain competitive with their renewal rates if they want to keep their mortgage portfolio.

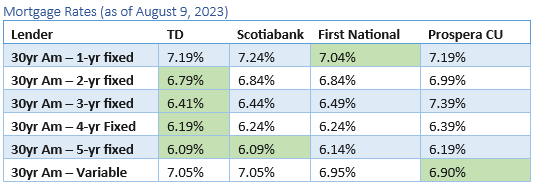

For those of you who have a mortgage in the 6% range, there may be an opportunity to switch your mortgage to a lower rate.

If you would like to see if this opportunity exists, please send me an email (adam@salemortgages.ca) with the following details so I can do a quick health-check:

- Mortgage Balance: ($430,000)

- Renewal Date: (April 2027)

- Original Term Length (2yr, 3yr, 4yr, 5yr)

- Interest Rate: (5.89%)

- Mortgage Payment: ($1,200 bi-weekly)

Alternatively, I am available to chat at 778-215-4121.

Thank you,

Adam Sale