Interest Rate Update

Bank of Canada announced today they will maintain the overnight interest rate at 0.25%.

This interest rate directly effects the Prime interest rate charged by lenders on Variable interest rate mortgages.

In addition to maintaining the overnight lending rate, the Bank of Canada will continue their Quantitative Easing program of purchasing $2bn worth of Government of Canada bonds per week.

This bond purchasing program is keeping the interest rates on the bonds suppressed which is producing ultra-low fixed mortgage interest rates.

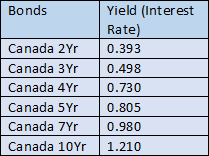

Bond Rates at end of day September 8:

Interpreting the chart:

Canada 2-yr: The low 2-yr bond rate means the discount received on Variable Interest mortgages will continue to stay around Prime – 1% on Conventional Mortgages & will be around prime – 1.15% on Insured Mortgages

Canada 3-Yr to Canada 5-Yr: Banks will continue to heavily market their 5-year fixed mortgage rates, but consumers will find cheaper mortgage rates in the 2, 3, & 4-year fixed mortgage durations. Borrowers should determine what their 5-year plan is before taking a 5-year fixed mortgage.

Canada 7-Yr & 10-Yr: Although the difference between the 5-yr and the 7-yr bonds are negligible, the difference in the mortgage rate is roughly a full percentage point at 2.94% & 3.30%. Borrowers should be aware of the high penalties involved with breaking a mortgage of this duration.

The next interest rate update is October 27, 2021.