There’s a new niche mortgage solution in British Columbia designed for the Equity Rich

Think of this mortgage solution as a reverse mortgage with no minimum age limit, no monthly payments & no income requirements!

Making this mortgage solution worth exploring for those who are interested in using their equity to purchase a 2nd home or investment property.

This mortgage solution is offered by Fraction Mortgage: https://www.fraction.com

How does it work?

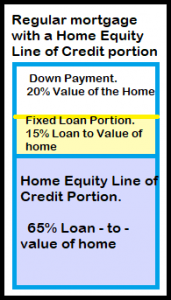

Homeowners can unlock up to 40% of their home’s equity.

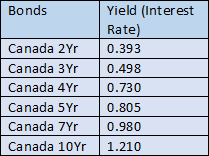

The interest rate on the mortgage is determined by the change in the home value over a 5-year term.

For example, if the home’s value has appreciated by 20% over 5-years, then the interest rate charged to the loan will be 20%/5 years = 4%/yr

The lender restricts the minimum annual interest charged to 3.5%, and the maximum rate will never exceed 7.99%.

Who benefits from this mortgage solution?

– Purchasing an investment property/2nd home and don’t want monthly mortgage payments.

– Loss of income, but don’t qualify for a reverse mortgage due to age

– Retired parents gifting a down-payment to their children

This mortgage solution is designed for equity rich borrowers with no income wanting to unlock their property’s equity without paying Private Lender rates of 8.99%-12%.

For a visual calculator on how this mortgage solution operates please click the link: https://app.fraction.com/estimate

I welcome any questions regarding this mortgage product.

– Adam Sale Mortgages